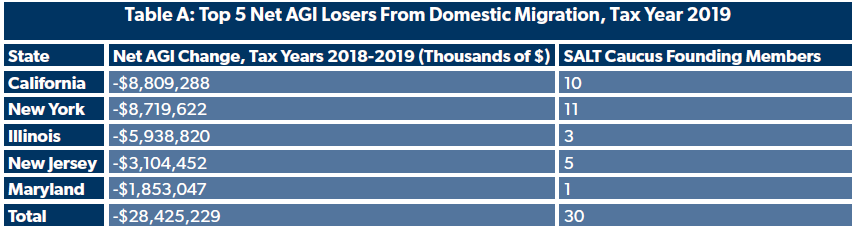

The House GOP's Higher Standard Deduction Means Even Fewer Households Should Care About The SALT Fight | Tax Policy Center

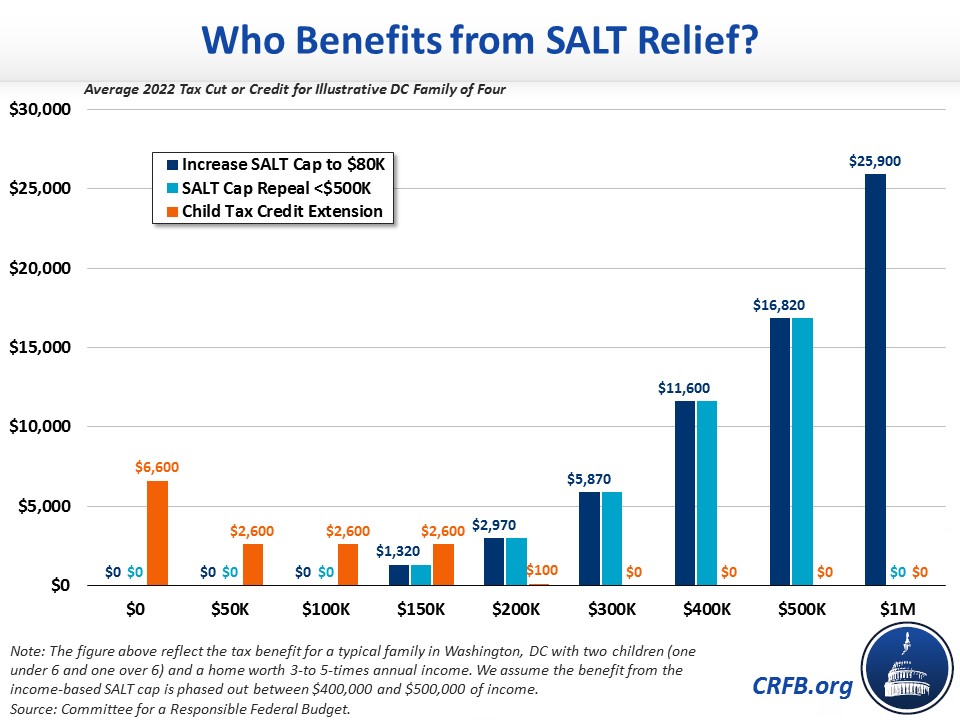

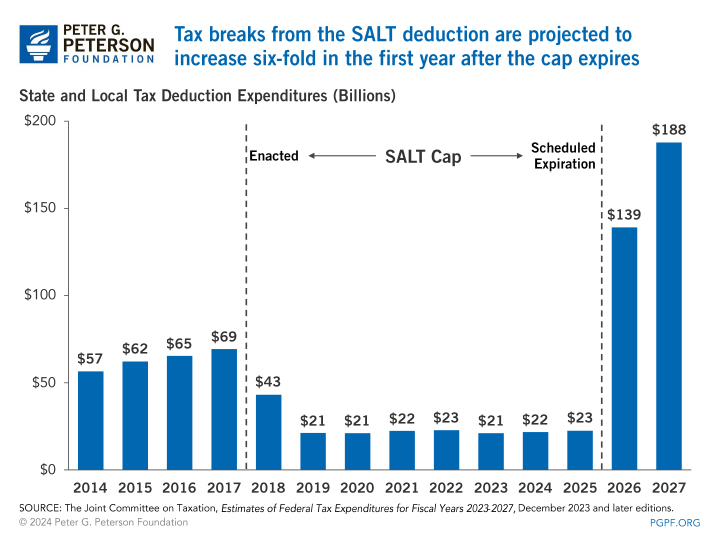

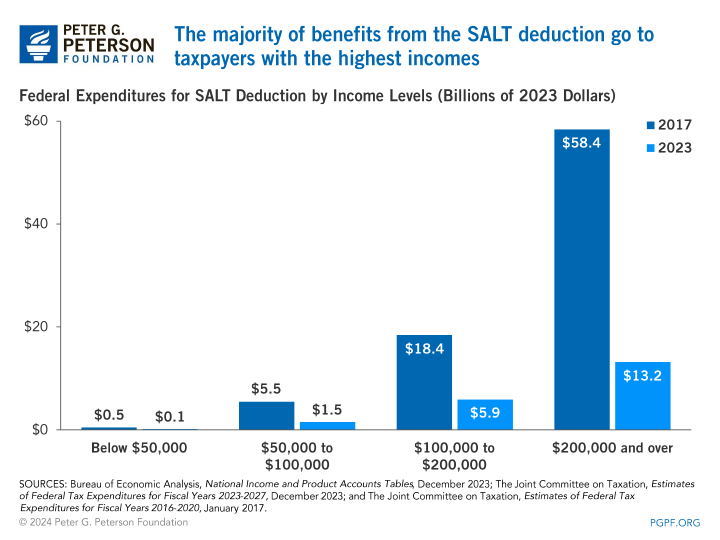

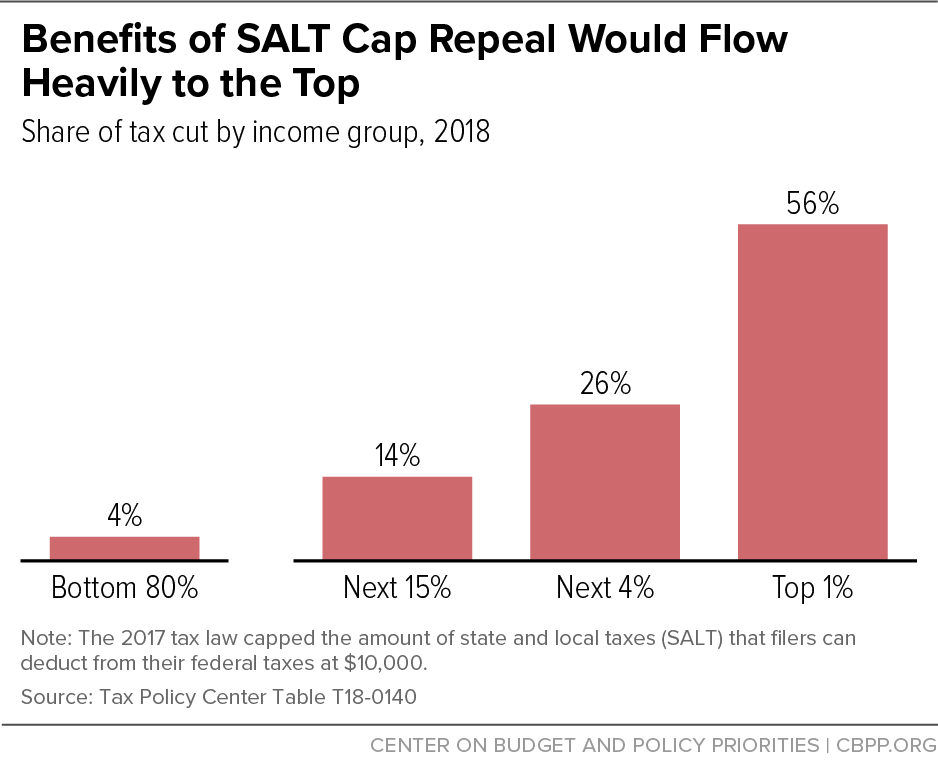

Repealing “SALT” Cap Would Be Regressive and Proposed Offset Would Use up Needed Progressive Revenues | Center on Budget and Policy Priorities

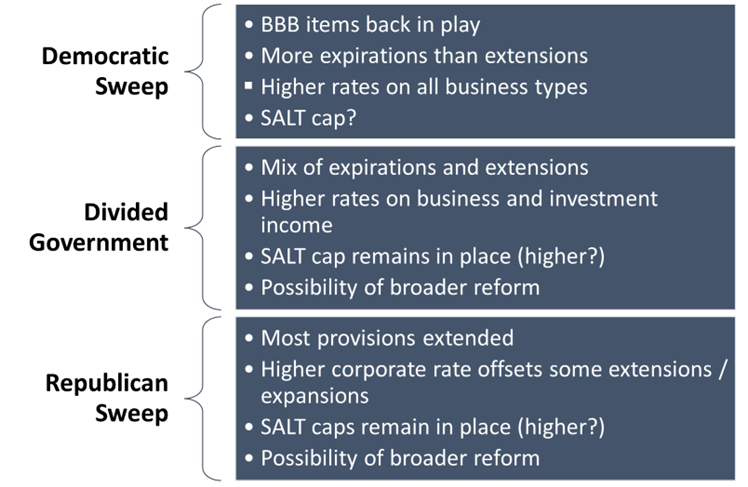

Good News for NJ Homeowners: SALT Cap Extension was Shot Down with new Tax Bill, Still Slated to Expire in 2025 : r/newjersey

Repealing the Federal Tax Law's Cap on State and Local Tax (SALT) Deductions Is No Improvement – ITEP

5-Year SALT Cap Repeal Would Be Costliest Part of Build Back Better | Committee for a Responsible Federal Budget